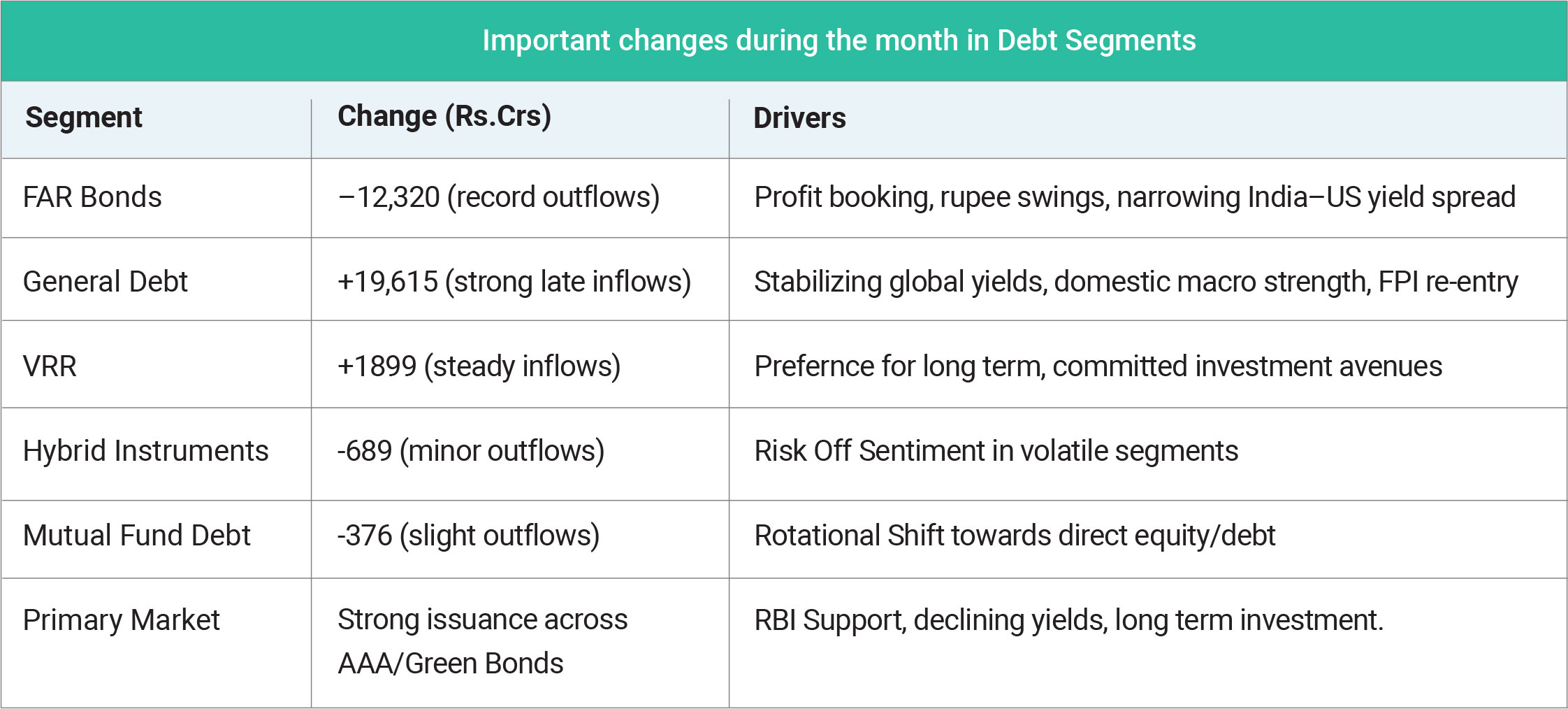

The Indian rupee remained volatile throughout May, influenced by geopolitical developments and rising global bond yields. As the yield gap between Indian debt and U.S. Treasuries narrowed, foreign investors rebalanced portfolios, particularly in the FAR/index-linked bonds, which are sensitive to global capital flows. Despite these headwinds, the underlying strength of India’s domestic economy and the RBI’s liquidity stance mitigated broader risks. The primary debt market was active, with high demand for new issuances, particularly in: AAA-rated corporate bonds, Infrastructure bonds and Green energy bonds. The favourable interest rate environment and robust investor appetite ensured smooth absorption of supply, reinforcing confidence in long-duration, high-quality debt

The Indian debt market in May 2025 reflected a nuanced interplay of domestic strength and global headwinds. While profit-taking and rupee volatility triggered heavy selling in index-linked (FAR) bonds, the broader market sentiment remained resilient, thanks to late-month FPI inflows into General Debt, RBI liquidity support, and softening yields. Demand for high-quality corporate and green bonds in the primary market further underscored investors’ confidence in India's long-term fundamentals. Going into June, debt market participants will be watching the RBI’s policy stance, currency stability, and global rate trends, which will be crucial in sustaining momentum across segments.